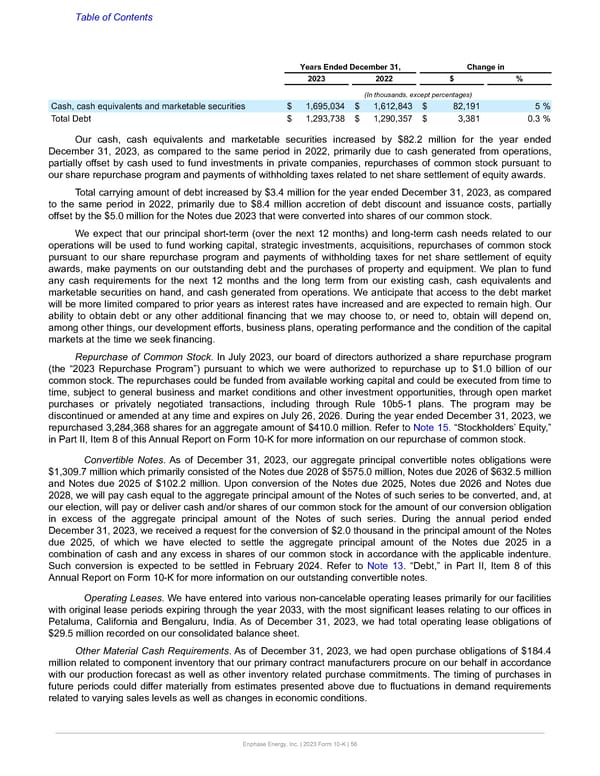

Table of Contents Years Ended December 31, Change in 2023 2022 $ % (In thousands, except percentages) Cash, cash equivalents and marketable securities $ 1,695,034 $ 1,612,843 $ 82,191 5 % Total Debt $ 1,293,738 $ 1,290,357 $ 3,381 0.3 % Our cash, cash equivalents and marketable securities increased by $82.2 million for the year ended December 31, 2023, as compared to the same period in 2022, primarily due to cash generated from operations, partially offset by cash used to fund investments in private companies, repurchases of common stock pursuant to our share repurchase program and payments of withholding taxes related to net share settlement of equity awards. Total carrying amount of debt increased by $3.4 million for the year ended December 31, 2023, as compared to the same period in 2022, primarily due to $8.4 million accretion of debt discount and issuance costs, partially offset by the $5.0 million for the Notes due 2023 that were converted into shares of our common stock. We expect that our principal short-term (over the next 12 months) and long-term cash needs related to our operations will be used to fund working capital, strategic investments, acquisitions, repurchases of common stock pursuant to our share repurchase program and payments of withholding taxes for net share settlement of equity awards, make payments on our outstanding debt and the purchases of property and equipment. We plan to fund any cash requirements for the next 12 months and the long term from our existing cash, cash equivalents and marketable securities on hand, and cash generated from operations. We anticipate that access to the debt market will be more limited compared to prior years as interest rates have increased and are expected to remain high. Our ability to obtain debt or any other additional financing that we may choose to, or need to, obtain will depend on, among other things, our development efforts, business plans, operating performance and the condition of the capital markets at the time we seek financing. Repurchase of Common Stock. In July 2023, our board of directors authorized a share repurchase program (the “2023 Repurchase Program”) pursuant to which we were authorized to repurchase up to $1.0 billion of our common stock. The repurchases could be funded from available working capital and could be executed from time to time, subject to general business and market conditions and other investment opportunities, through open market purchases or privately negotiated transactions, including through Rule 10b5-1 plans. The program may be discontinued or amended at any time and expires on July 26, 2026. During the year ended December 31, 2023, we repurchased 3,284,368 shares for an aggregate amount of $410.0 million. Refer to Note 15. “Stockholders’ Equity,” in Part II, Item 8 of this Annual Report on Form 10-K for more information on our repurchase of common stock. Convertible Notes. As of December 31, 2023, our aggregate principal convertible notes obligations were $1,309.7 million which primarily consisted of the Notes due 2028 of $575.0 million, Notes due 2026 of $632.5 million and Notes due 2025 of $102.2 million. Upon conversion of the Notes due 2025, Notes due 2026 and Notes due 2028, we will pay cash equal to the aggregate principal amount of the Notes of such series to be converted, and, at our election, will pay or deliver cash and/or shares of our common stock for the amount of our conversion obligation in excess of the aggregate principal amount of the Notes of such series. During the annual period ended December 31, 2023, we received a request for the conversion of $2.0 thousand in the principal amount of the Notes due 2025, of which we have elected to settle the aggregate principal amount of the Notes due 2025 in a combination of cash and any excess in shares of our common stock in accordance with the applicable indenture. Such conversion is expected to be settled in February 2024. Refer to Note 13. “Debt,” in Part II, Item 8 of this Annual Report on Form 10-K for more information on our outstanding convertible notes. Operating Leases. We have entered into various non-cancelable operating leases primarily for our facilities with original lease periods expiring through the year 2033, with the most significant leases relating to our offices in Petaluma, California and Bengaluru, India. As of December 31, 2023, we had total operating lease obligations of $29.5 million recorded on our consolidated balance sheet. Other Material Cash Requirements. As of December 31, 2023, we had open purchase obligations of $184.4 million related to component inventory that our primary contract manufacturers procure on our behalf in accordance with our production forecast as well as other inventory related purchase commitments. The timing of purchases in future periods could differ materially from estimates presented above due to fluctuations in demand requirements related to varying sales levels as well as changes in economic conditions. Enphase Energy, Inc. | 2023 Form 10-K | 56

Annual Report Page 55 Page 57

Annual Report Page 55 Page 57