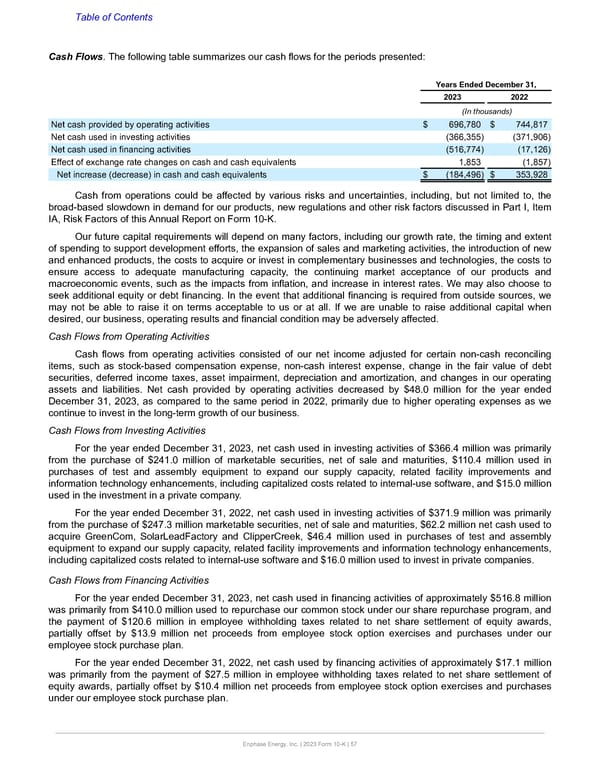

Table of Contents Cash Flows. The following table summarizes our cash flows for the periods presented: Years Ended December 31, 2023 2022 (In thousands) Net cash provided by operating activities $ 696,780 $ 744,817 Net cash used in investing activities (366,355) (371,906) Net cash used in financing activities (516,774) (17,126) Effect of exchange rate changes on cash and cash equivalents 1,853 (1,857) Net increase (decrease) in cash and cash equivalents $ (184,496) $ 353,928 Cash from operations could be affected by various risks and uncertainties, including, but not limited to, the broad-based slowdown in demand for our products, new regulations and other risk factors discussed in Part I, Item IA, Risk Factors of this Annual Report on Form 10-K. Our future capital requirements will depend on many factors, including our growth rate, the timing and extent of spending to support development efforts, the expansion of sales and marketing activities, the introduction of new and enhanced products, the costs to acquire or invest in complementary businesses and technologies, the costs to ensure access to adequate manufacturing capacity, the continuing market acceptance of our products and macroeconomic events, such as the impacts from inflation, and increase in interest rates. We may also choose to seek additional equity or debt financing. In the event that additional financing is required from outside sources, we may not be able to raise it on terms acceptable to us or at all. If we are unable to raise additional capital when desired, our business, operating results and financial condition may be adversely affected. Cash Flows from Operating Activities Cash flows from operating activities consisted of our net income adjusted for certain non-cash reconciling items, such as stock-based compensation expense, non-cash interest expense, change in the fair value of debt securities, deferred income taxes, asset impairment, depreciation and amortization, and changes in our operating assets and liabilities. Net cash provided by operating activities decreased by $48.0 million for the year ended December 31, 2023, as compared to the same period in 2022, primarily due to higher operating expenses as we continue to invest in the long-term growth of our business. Cash Flows from Investing Activities For the year ended December 31, 2023, net cash used in investing activities of $366.4 million was primarily from the purchase of $241.0 million of marketable securities, net of sale and maturities, $110.4 million used in purchases of test and assembly equipment to expand our supply capacity, related facility improvements and information technology enhancements, including capitalized costs related to internal-use software, and $15.0 million used in the investment in a private company. For the year ended December 31, 2022, net cash used in investing activities of $371.9 million was primarily from the purchase of $247.3 million marketable securities, net of sale and maturities, $62.2 million net cash used to acquire GreenCom, SolarLeadFactory and ClipperCreek, $46.4 million used in purchases of test and assembly equipment to expand our supply capacity, related facility improvements and information technology enhancements, including capitalized costs related to internal-use software and $16.0 million used to invest in private companies. Cash Flows from Financing Activities For the year ended December 31, 2023, net cash used in financing activities of approximately $516.8 million was primarily from $410.0 million used to repurchase our common stock under our share repurchase program, and the payment of $120.6 million in employee withholding taxes related to net share settlement of equity awards, partially offset by $13.9 million net proceeds from employee stock option exercises and purchases under our employee stock purchase plan. For the year ended December 31, 2022, net cash used by financing activities of approximately $17.1 million was primarily from the payment of $27.5 million in employee withholding taxes related to net share settlement of equity awards, partially offset by $10.4 million net proceeds from employee stock option exercises and purchases under our employee stock purchase plan. Enphase Energy, Inc. | 2023 Form 10-K | 57

Annual Report Page 56 Page 58

Annual Report Page 56 Page 58