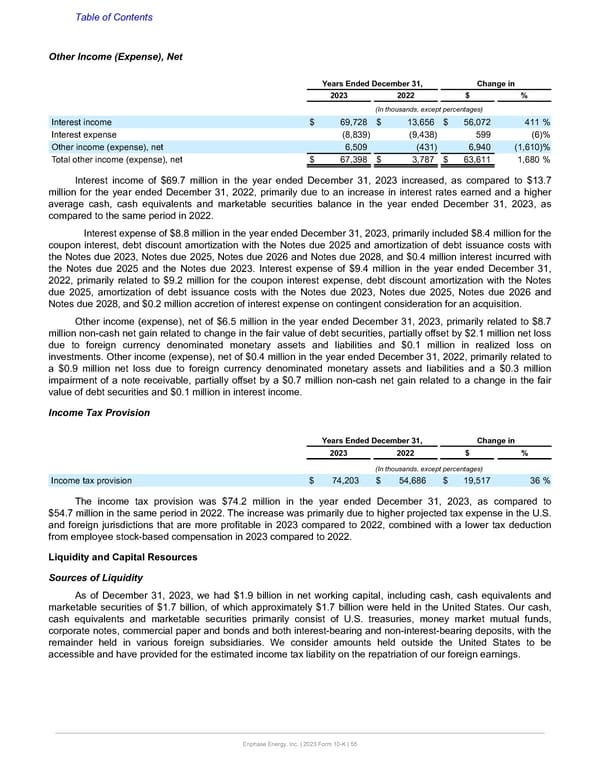

Table of Contents Other Income (Expense), Net Years Ended December 31, Change in 2023 2022 $ % (In thousands, except percentages) Interest income $ 69,728 $ 13,656 $ 56,072 411 % Interest expense (8,839) (9,438) 599 (6) % Other income (expense), net 6,509 (431) 6,940 (1,610) % Total other income (expense), net $ 67,398 $ 3,787 $ 63,611 1,680 % Interest income of $69.7 million in the year ended December 31, 2023 increased, as compared to $13.7 million for the year ended December 31, 2022, primarily due to an increase in interest rates earned and a higher average cash, cash equivalents and marketable securities balance in the year ended December 31, 2023, as compared to the same period in 2022. Interest expense of $8.8 million in the year ended December 31, 2023, primarily included $8.4 million for the coupon interest, debt discount amortization with the Notes due 2025 and amortization of debt issuance costs with the Notes due 2023, Notes due 2025, Notes due 2026 and Notes due 2028, and $0.4 million interest incurred with the Notes due 2025 and the Notes due 2023. Interest expense of $9.4 million in the year ended December 31, 2022, primarily related to $9.2 million for the coupon interest expense, debt discount amortization with the Notes due 2025, amortization of debt issuance costs with the Notes due 2023, Notes due 2025, Notes due 2026 and Notes due 2028, and $0.2 million accretion of interest expense on contingent consideration for an acquisition. Other income (expense), net of $6.5 million in the year ended December 31, 2023, primarily related to $8.7 million non-cash net gain related to change in the fair value of debt securities, partially offset by $2.1 million net loss due to foreign currency denominated monetary assets and liabilities and $0.1 million in realized loss on investments. Other income (expense), net of $0.4 million in the year ended December 31, 2022, primarily related to a $0.9 million net loss due to foreign currency denominated monetary assets and liabilities and a $0.3 million impairment of a note receivable, partially offset by a $0.7 million non-cash net gain related to a change in the fair value of debt securities and $0.1 million in interest income. Income Tax Provision Years Ended December 31, Change in 2023 2022 $ % (In thousands, except percentages) Income tax provision $ 74,203 $ 54,686 $ 19,517 36 % The income tax provision was $74.2 million in the year ended December 31, 2023, as compared to $54.7 million in the same period in 2022. The increase was primarily due to higher projected tax expense in the U.S. and foreign jurisdictions that are more profitable in 2023 compared to 2022, combined with a lower tax deduction from employee stock-based compensation in 2023 compared to 2022. Liquidity and Capital Resources Sources of Liquidity As of December 31, 2023, we had $1.9 billion in net working capital, including cash, cash equivalents and marketable securities of $1.7 billion, of which approximately $1.7 billion were held in the United States. Our cash, cash equivalents and marketable securities primarily consist of U.S. treasuries, money market mutual funds, corporate notes, commercial paper and bonds and both interest-bearing and non-interest-bearing deposits, with the remainder held in various foreign subsidiaries. We consider amounts held outside the United States to be accessible and have provided for the estimated income tax liability on the repatriation of our foreign earnings. Enphase Energy, Inc. | 2023 Form 10-K | 55

Annual Report Page 54 Page 56

Annual Report Page 54 Page 56