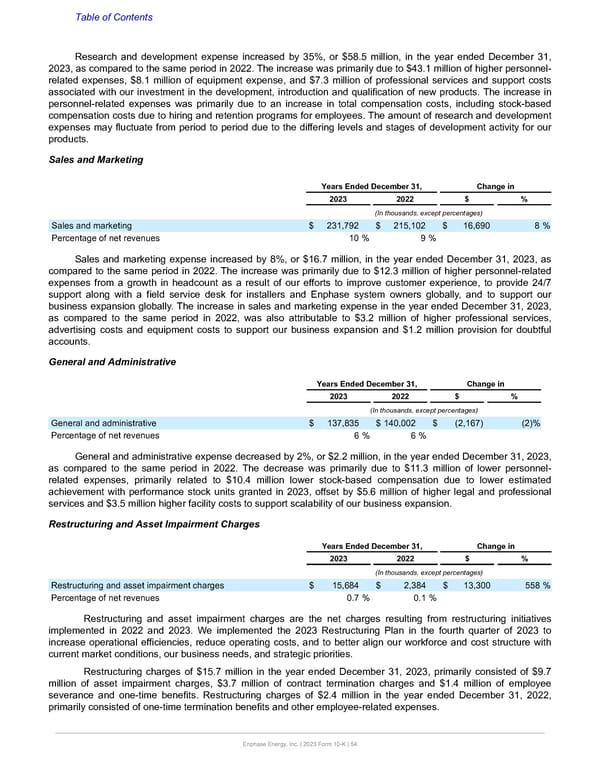

Table of Contents Research and development expense increased by 35%, or $58.5 million, in the year ended December 31, 2023, as compared to the same period in 2022. The increase was primarily due to $43.1 million of higher personnel- related expenses, $8.1 million of equipment expense, and $7.3 million of professional services and support costs associated with our investment in the development, introduction and qualification of new products. The increase in personnel-related expenses was primarily due to an increase in total compensation costs, including stock-based compensation costs due to hiring and retention programs for employees. The amount of research and development expenses may fluctuate from period to period due to the differing levels and stages of development activity for our products. Sales and Marketing Years Ended December 31, Change in 2023 2022 $ % (In thousands, except percentages) Sales and marketing $ 231,792 $ 215,102 $ 16,690 8 % Percentage of net revenues 10 % 9 % Sales and marketing expense increased by 8%, or $16.7 million, in the year ended December 31, 2023, as compared to the same period in 2022. The increase was primarily due to $12.3 million of higher personnel-related expenses from a growth in headcount as a result of our efforts to improve customer experience, to provide 24/7 support along with a field service desk for installers and Enphase system owners globally, and to support our business expansion globally. The increase in sales and marketing expense in the year ended December 31, 2023, as compared to the same period in 2022, was also attributable to $3.2 million of higher professional services, advertising costs and equipment costs to support our business expansion and $1.2 million provision for doubtful accounts. General and Administrative Years Ended December 31, Change in 2023 2022 $ % (In thousands, except percentages) General and administrative $ 137,835 $ 140,002 $ (2,167) (2) % Percentage of net revenues 6 % 6 % General and administrative expense decreased by 2%, or $2.2 million, in the year ended December 31, 2023, as compared to the same period in 2022. The decrease was primarily due to $11.3 million of lower personnel- related expenses, primarily related to $10.4 million lower stock-based compensation due to lower estimated achievement with performance stock units granted in 2023, offset by $5.6 million of higher legal and professional services and $3.5 million higher facility costs to support scalability of our business expansion. Restructuring and Asset Impairment Charges Years Ended December 31, Change in 2023 2022 $ % (In thousands, except percentages) Restructuring and asset impairment charges $ 15,684 $ 2,384 $ 13,300 558 % Percentage of net revenues 0.7 % 0.1 % Restructuring and asset impairment charges are the net charges resulting from restructuring initiatives implemented in 2022 and 2023. We implemented the 2023 Restructuring Plan in the fourth quarter of 2023 to increase operational efficiencies, reduce operating costs, and to better align our workforce and cost structure with current market conditions, our business needs, and strategic priorities. Restructuring charges of $15.7 million in the year ended December 31, 2023, primarily consisted of $9.7 million of asset impairment charges, $3.7 million of contract termination charges and $1.4 million of employee severance and one-time benefits. Restructuring charges of $2.4 million in the year ended December 31, 2022, primarily consisted of one-time termination benefits and other employee-related expenses. Enphase Energy, Inc. | 2023 Form 10-K | 54

Annual Report Page 53 Page 55

Annual Report Page 53 Page 55