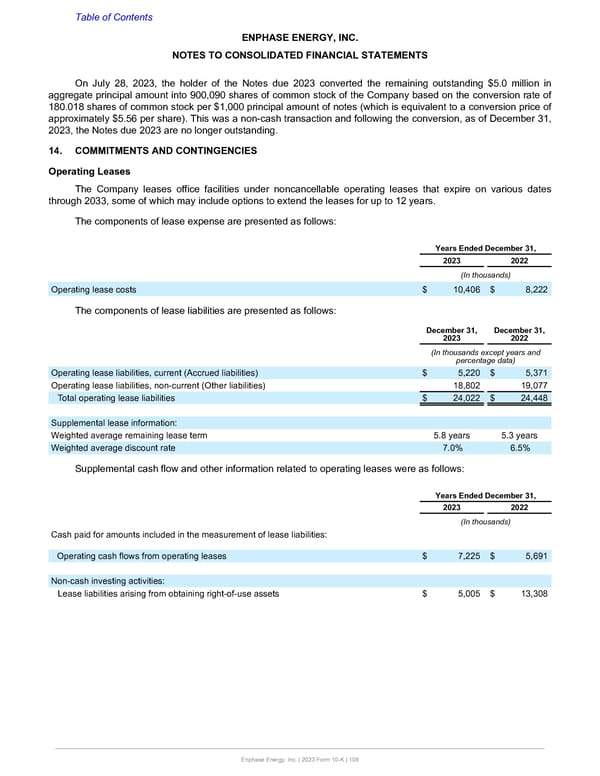

Table of Contents ENPHASE ENERGY, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS On July 28, 2023, the holder of the Notes due 2023 converted the remaining outstanding $5.0 million in aggregate principal amount into 900,090 shares of common stock of the Company based on the conversion rate of 180.018 shares of common stock per $1,000 principal amount of notes (which is equivalent to a conversion price of approximately $5.56 per share). This was a non-cash transaction and following the conversion, as of December 31, 2023, the Notes due 2023 are no longer outstanding. 14. COMMITMENTS AND CONTINGENCIES Operating Leases The Company leases office facilities under noncancellable operating leases that expire on various dates through 2033, some of which may include options to extend the leases for up to 12 years. The components of lease expense are presented as follows: Years Ended December 31, 2023 2022 (In thousands) Operating lease costs $ 10,406 $ 8,222 The components of lease liabilities are presented as follows: December 31, December 31, 2023 2022 (In thousands except years and percentage data) Operating lease liabilities, current (Accrued liabilities) $ 5,220 $ 5,371 Operating lease liabilities, non-current (Other liabilities) 18,802 19,077 Total operating lease liabilities $ 24,022 $ 24,448 Supplemental lease information: Weighted average remaining lease term 5.8 years 5.3 years Weighted average discount rate 7.0% 6.5% Supplemental cash flow and other information related to operating leases were as follows: Years Ended December 31, 2023 2022 (In thousands) Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows from operating leases $ 7,225 $ 5,691 Non-cash investing activities: Lease liabilities arising from obtaining right-of-use assets $ 5,005 $ 13,308 Enphase Energy, Inc. | 2023 Form 10-K | 109

Annual Report Page 108 Page 110

Annual Report Page 108 Page 110