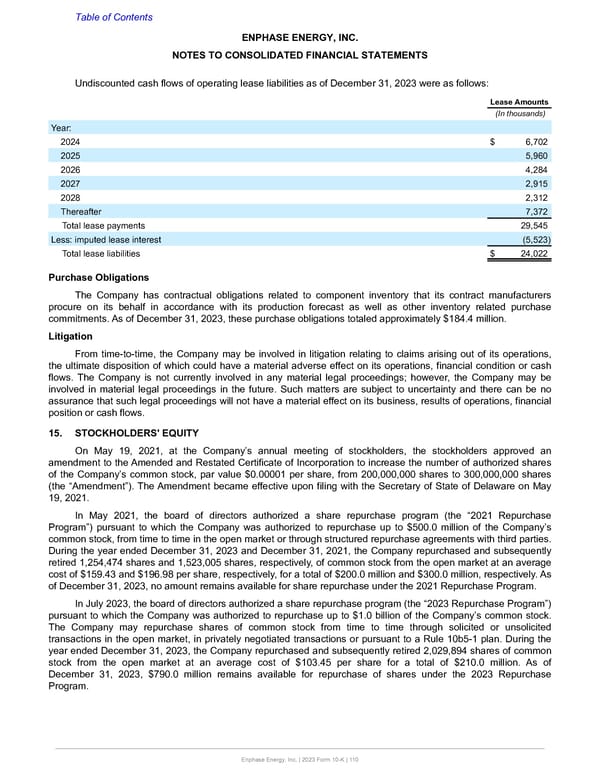

Table of Contents ENPHASE ENERGY, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Undiscounted cash flows of operating lease liabilities as of December 31, 2023 were as follows: Lease Amounts (In thousands) Year: 2024 $ 6,702 2025 5,960 2026 4,284 2027 2,915 2028 2,312 Thereafter 7,372 Total lease payments 29,545 Less: imputed lease interest (5,523) Total lease liabilities $ 24,022 Purchase Obligations The Company has contractual obligations related to component inventory that its contract manufacturers procure on its behalf in accordance with its production forecast as well as other inventory related purchase commitments. As of December 31, 2023, these purchase obligations totaled approximately $184.4 million. Litigation From time-to-time, the Company may be involved in litigation relating to claims arising out of its operations, the ultimate disposition of which could have a material adverse effect on its operations, financial condition or cash flows. The Company is not currently involved in any material legal proceedings; however, the Company may be involved in material legal proceedings in the future. Such matters are subject to uncertainty and there can be no assurance that such legal proceedings will not have a material effect on its business, results of operations, financial position or cash flows. 15. STOCKHOLDERS' EQUITY On May 19, 2021, at the Company’s annual meeting of stockholders, the stockholders approved an amendment to the Amended and Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s common stock, par value $0.00001 per share, from 200,000,000 shares to 300,000,000 shares (the “Amendment”). The Amendment became effective upon filing with the Secretary of State of Delaware on May 19, 2021. In May 2021, the board of directors authorized a share repurchase program (the “2021 Repurchase Program”) pursuant to which the Company was authorized to repurchase up to $500.0 million of the Company’s common stock, from time to time in the open market or through structured repurchase agreements with third parties. During the year ended December 31, 2023 and December 31, 2021, the Company repurchased and subsequently retired 1,254,474 shares and 1,523,005 shares, respectively, of common stock from the open market at an average cost of $159.43 and $196.98 per share, respectively, for a total of $200.0 million and $300.0 million, respectively. As of December 31, 2023, no amount remains available for share repurchase under the 2021 Repurchase Program. In July 2023, the board of directors authorized a share repurchase program (the “2023 Repurchase Program”) pursuant to which the Company was authorized to repurchase up to $1.0 billion of the Company’s common stock. The Company may repurchase shares of common stock from time to time through solicited or unsolicited transactions in the open market, in privately negotiated transactions or pursuant to a Rule 10b5-1 plan. During the year ended December 31, 2023, the Company repurchased and subsequently retired 2,029,894 shares of common stock from the open market at an average cost of $103.45 per share for a total of $210.0 million. As of December 31, 2023, $790.0 million remains available for repurchase of shares under the 2023 Repurchase Program. Enphase Energy, Inc. | 2023 Form 10-K | 110

Annual Report Page 109 Page 111

Annual Report Page 109 Page 111