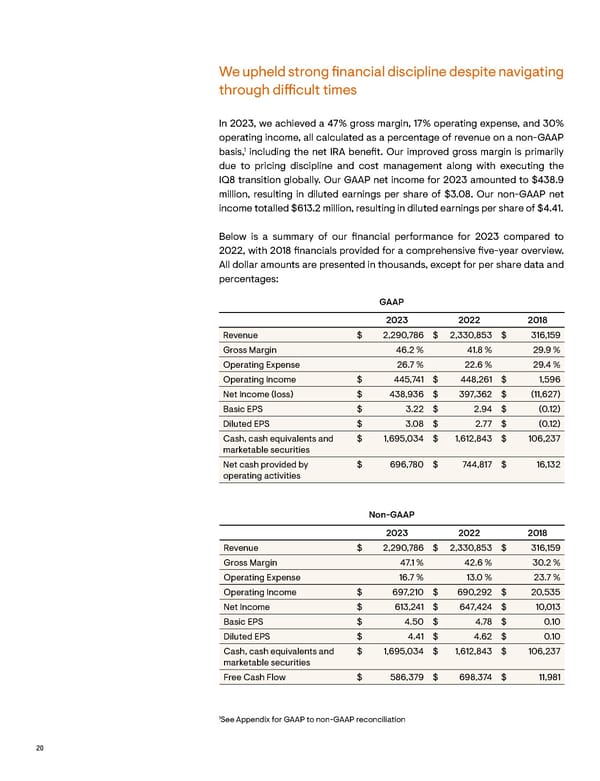

We upheld strong nancial discipline despite navigating We executed on most of the priorities I highlighted in through di cult times my letter a year ago In 2023, we achieved a 47% gross margin, 17% operating expense, and 30% “As of December 31, 2023, we had In summary, we made signi cant progress on our priorities, albeit falling operating income, all calculated as a percentage of revenue on a non-GAAP 3,157 employees, and I am proud of short on revenue growth. We enhanced product quality and ensured 1 their hard work and execution.” around-the clock customer support, and achieved a global NPS score of 77. basis, including the net IRA bene t. Our improved gross margin is primarily due to pricing discipline and cost management along with executing the We introduced our third-generation IQ Battery 5P with higher power and IQ8 transition globally. Our GAAP net income for 2023 amounted to $438.9 reduced commissioning times, while the introduction of IQ8 Microinverters million, resulting in diluted earnings per share of $3.08. Our non-GAAP net and IQ Batteries expanded our reach across multiple countries. In addition, income totalled $613.2 million, resulting in diluted earnings per share of $4.41. we successfully launched our small commercial product and IQ Smart EV chargers in the United States. By maintaining a lean approach, we invested in Below is a summary of our nancial performance for 2023 compared to innovation while remaining pro table and generating free cash ow. There is 2022, with 2018 nancials provided for a comprehensive ve-year overview. room for improvement in channel management and avoiding manufacturing All dollar amounts are presented in thousands, except for per share data and closures; we are actively addressing these areas for future growth. As of percentages: December 31, 2023, we had 3,157 employees, and I am proud of their hard work and execution. GAAP 2023 2022 2018 Revenue $ 2,290,786 $ 2,330,853 $ 316,159 Gross Margin 46.2 % 41.8 % 29.9 % Operating Expense 26.7 % 22.6 % 29.4 % Operating Income $ 445,741 $ 448,261 $ 1,596 Net Income (loss) $ 438,936 $ 397,362 $ (11,627) Basic EPS $ 3.22 $ 2.94 $ (0.12) Diluted EPS $ 3.08 $ 2.77 $ (0.12) Cash, cash equivalents and $ 1,695,034 $ 1,612,843 $ 106,237 marketable securities Net cash provided by $ 696,780 $ 744,817 $ 16,132 operating activities Non-GAAP 2023 2022 2018 Revenue $ 2,290,786 $ 2,330,853 $ 316,159 Gross Margin 47.1 % 42.6 % 30.2 % Operating Expense 16.7 % 13.0 % 23.7 % Operating Income $ 697,210 $ 690,292 $ 20,535 Net Income $ 613,241 $ 647,424 $ 10,013 Basic EPS $ 4.50 $ 4.78 $ 0.10 Diluted EPS $ 4.41 $ 4.62 $ 0.10 Cash, cash equivalents and $ 1,695,034 $ 1,612,843 $ 106,237 marketable securities Enphase employees at an industry tradeshow in Sinsheim, Germany Free Cash Flow $ 586,379 $ 698,374 $ 11,981 1See Appendix for GAAP to non-GAAP reconciliation 20 ENPHASE CEO LETTER TO SHAREHOLDERS 2023 21

CEO Letter to Shareholders Page 19 Page 21

CEO Letter to Shareholders Page 19 Page 21