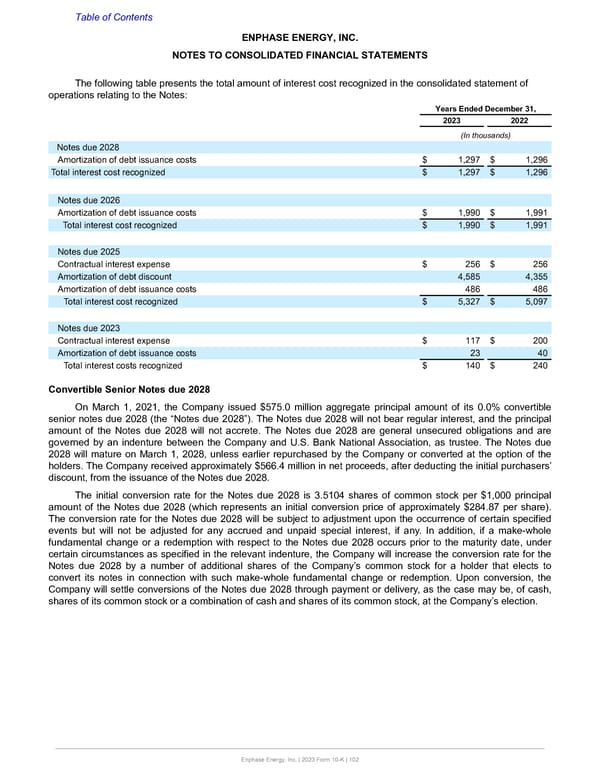

Table of Contents ENPHASE ENERGY, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The following table presents the total amount of interest cost recognized in the consolidated statement of operations relating to the Notes: Years Ended December 31, 2023 2022 (In thousands) Notes due 2028 Amortization of debt issuance costs $ 1,297 $ 1,296 Total interest cost recognized $ 1,297 $ 1,296 Notes due 2026 Amortization of debt issuance costs $ 1,990 $ 1,991 Total interest cost recognized $ 1,990 $ 1,991 Notes due 2025 Contractual interest expense $ 256 $ 256 Amortization of debt discount 4,585 4,355 Amortization of debt issuance costs 486 486 Total interest cost recognized $ 5,327 $ 5,097 Notes due 2023 Contractual interest expense $ 117 $ 200 Amortization of debt issuance costs 23 40 Total interest costs recognized $ 140 $ 240 Convertible Senior Notes due 2028 On March 1, 2021, the Company issued $575.0 million aggregate principal amount of its 0.0% convertible senior notes due 2028 (the “Notes due 2028”). The Notes due 2028 will not bear regular interest, and the principal amount of the Notes due 2028 will not accrete. The Notes due 2028 are general unsecured obligations and are governed by an indenture between the Company and U.S. Bank National Association, as trustee. The Notes due 2028 will mature on March 1, 2028, unless earlier repurchased by the Company or converted at the option of the holders. The Company received approximately $566.4 million in net proceeds, after deducting the initial purchasers’ discount, from the issuance of the Notes due 2028. The initial conversion rate for the Notes due 2028 is 3.5104 shares of common stock per $1,000 principal amount of the Notes due 2028 (which represents an initial conversion price of approximately $284.87 per share). The conversion rate for the Notes due 2028 will be subject to adjustment upon the occurrence of certain specified events but will not be adjusted for any accrued and unpaid special interest, if any. In addition, if a make-whole fundamental change or a redemption with respect to the Notes due 2028 occurs prior to the maturity date, under certain circumstances as specified in the relevant indenture, the Company will increase the conversion rate for the Notes due 2028 by a number of additional shares of the Company’s common stock for a holder that elects to convert its notes in connection with such make-whole fundamental change or redemption. Upon conversion, the Company will settle conversions of the Notes due 2028 through payment or delivery, as the case may be, of cash, shares of its common stock or a combination of cash and shares of its common stock, at the Company’s election. Enphase Energy, Inc. | 2023 Form 10-K | 102

Annual Report Page 101 Page 103

Annual Report Page 101 Page 103