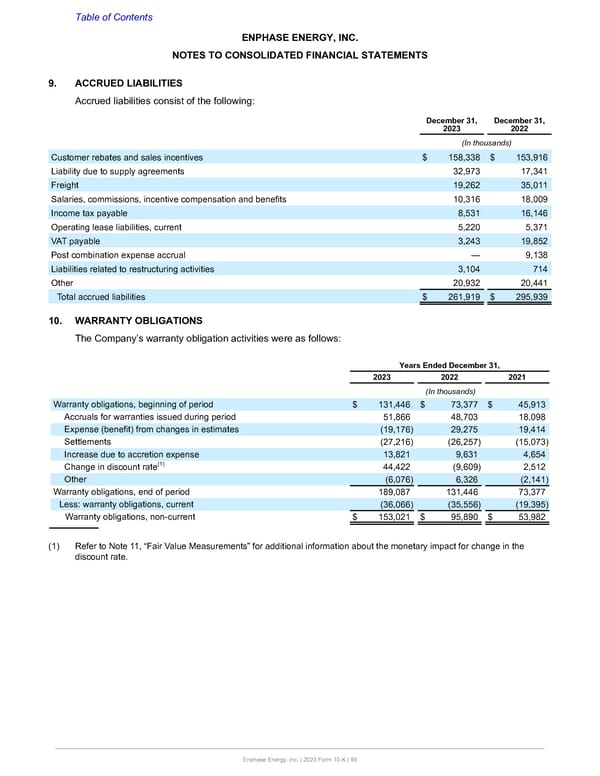

Table of Contents ENPHASE ENERGY, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 9. ACCRUED LIABILITIES Accrued liabilities consist of the following: December 31, December 31, 2023 2022 (In thousands) Customer rebates and sales incentives $ 158,338 $ 153,916 Liability due to supply agreements 32,973 17,341 Freight 19,262 35,011 Salaries, commissions, incentive compensation and benefits 10,316 18,009 Income tax payable 8,531 16,146 Operating lease liabilities, current 5,220 5,371 VAT payable 3,243 19,852 Post combination expense accrual — 9,138 Liabilities related to restructuring activities 3,104 714 Other 20,932 20,441 Total accrued liabilities $ 261,919 $ 295,939 10. WARRANTY OBLIGATIONS The Company’s warranty obligation activities were as follows: Years Ended December 31, 2023 2022 2021 (In thousands) Warranty obligations, beginning of period $ 131,446 $ 73,377 $ 45,913 Accruals for warranties issued during period 51,866 48,703 18,098 Expense (benefit) from changes in estimates (19,176) 29,275 19,414 Settlements (27,216) (26,257) (15,073) Increase due to accretion expense 13,821 9,631 4,654 (1) Change in discount rate 44,422 (9,609) 2,512 Other (6,076) 6,326 (2,141) Warranty obligations, end of period 189,087 131,446 73,377 Less: warranty obligations, current (36,066) (35,556) (19,395) Warranty obligations, non-current $ 153,021 $ 95,890 $ 53,982 (1) Refer to Note 11, “Fair Value Measurements” for additional information about the monetary impact for change in the discount rate. Enphase Energy, Inc. | 2023 Form 10-K | 95

Annual Report Page 94 Page 96

Annual Report Page 94 Page 96